The top two factors that determine your FICO score are your history of paying back what you owe and how much you owe compared to your credit limits.

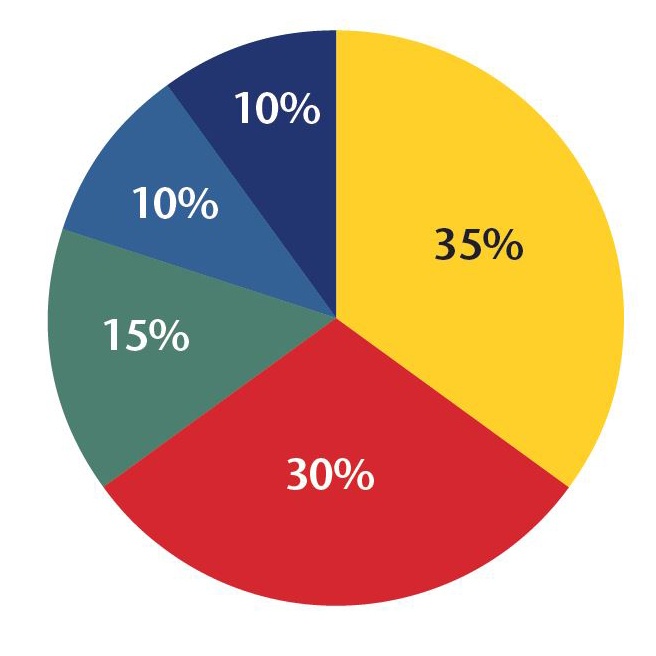

However, five elements make up your FICO score, a number between 350 and 850 that indicates to a lender how creditworthy you are and how likely you are to pay off your debts. The higher the number, the more attractive the you are to a lender. Each element comprising your FICO score is weighted:

- Payment History (35%). Making your payments on time and avoiding late payments on your accounts has the most impact on your credit score. Even one late payment reported to credit bureaus can send your FICO score southward.

- Capacity (30%). This is the difference between your credit limits and the balances you carry. If you’re maxing out your credit lines, your score’s going to take a hit.

- Length of Credit (15%). This takes into account your oldest credit line and the average opened date of all your other lines of credit. This gives someone with a longer credit history a slight edge on their FICO score.

- Mix of Credit (10%). Lenders like to see a mix of different types of credit: not just revolving loans like credit cards, but things like installment loans (cars, personal) and mortgage loans/HELOCs.

- Accumulation of Debt (10%). Your FICO score reflects the number of times potential lenders check your credit and the number of open credit lines you carry. Lots of inquiries can drag your score down.

You can see that those first two elements make up the majority of the score – 65% of it! – and even better, you have some influence over these elements.

So if you want to boost your credit score, take positive actions that’ll have the most impact on it:

- Make your payments on time. This is probably the most influential factor determining your FICO score. And although on-time is best, late is better than never, which will sink your credit score quickly. Until a payment is 30 days past due, it won’t be reported to the credit bureaus. You may have to pay a late fee if you’re three weeks late, but your credit score shouldn’t suffer.

- Schedule or mail credit card and loan payments at least 10 days before their due dates. This ensures payments have plenty of time to be posted to your accounts.

- Get online. Online bill payment offers the advantage of being able to pay many bills instantly, eliminating worries about missing mail or a looming deadline. You can also get reminders when bills are due, check when your payments clear, and get a better grasp on your financial status.

- Change the due date on your bills. Many lenders will allow you to change to a due date that works better for your budget. For example, you may be having a tough time paying a credit card bill on the 5th of the month, right after you’ve paid your rent on the 1st. Having the due date moved to the 15th could give you the breathing room to keep your account current.

- Focus your repayment efforts on credit cards with balances nearing your credit limits. When you’re “maxed out” on your credit cards, it means your utilization rate is high, which influences your credit score by 30%.

- Request higher credit limits or even a new line of credit. Sometimes you can be a responsible creditor but have a FICO score that’s much lower than it should be. This can occur when you have open credit lines with low limits, which are easy to max out, or when you keep only one or two credit cards with balances well above the ideal 30% utilization rate. As long as you continue to keep your debt load low, higher limits on your credit lines will lower your utilization rates, thus giving you a significant bump in your FICO score.

Using that last tip alone, we have members who have pushed their credit score from the mid 700s to the low 800s! If you have any tips to improve these important two elements of a FICO score, we’d love to hear them. Post your thoughts below!

To get a better understanding of your credit report and how it is impacting your credit score, schedule a free credit score review. A member of the Hanscom Federal Credit Union team will share your report with you, identify errors and explain how to correct them, and offer tips on how to improve your credit score.

Comment