Here’s what you need to know before you consolidate credit card debt.

A balance transfer is exactly what it says it is: the movement of a credit card balance over to another card. Borrowers like balance transfers because they can transfer higher interest debt to a lower interest card.

The process of applying for a balance transfer is fairly simple, although there will be variations between lenders. You apply for the new line of credit with your chosen lender. Some lenders will ask you to provide the balances and account numbers you want to transfer when you apply; others will not. Once you’re approved, your new lender will contact your old lenders, pay off your debts, and apply that debt to your new card. This can take up to three weeks, so you should ensure you make your minimum payments due on your old cards until the transfer is complete.

Keep in mind that your new lender may give you a credit line that’s less than the amount of the total of your old debts. Your approved amount will depend on your credit history, credit score, credit utilization, and income.

Selecting the Best Offer

So it’s time to choose a new balance transfer card. How do you evaluate the offers? It’s a fairly straightforward process to ensure you make a sound financial decision.

First, gather up the account numbers, balances, and interest rates for your current credit cards. You don’t want to make the mistake of applying for a credit card that has a higher interest rate than your current cards’ interest rates.

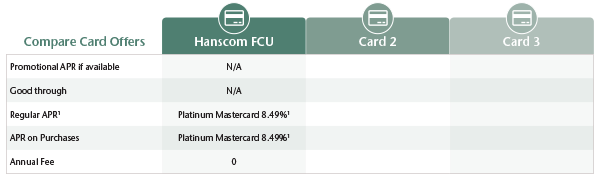

Second, take the time to evaluate the specifics of the offer. We’ve created a fillable chart below that lets you compare card offers. You’ll want to look at not just the interest rate, but if it’s a promotional rate, how long it will be in effect. Once that period is over, you’ll be charged the card’s normal ongoing rate, which could erase any savings you’ve realized during the promotional period if you’re still carrying a balance. A 0% interest card can be a great deal if you pay off the balance before the promotion period ends, but it can cost you more if you know you won’t be able to pay off the balance or if you miss a payment and incur late fees and a penalty interest rate.

1 APR=Annual Percentage Rate. Rates shown are the lowest possible rates currently offered. Other rates are available, based on your credit profile and loan terms. Contact Member Services at 800-656-4328 for rate details. You can also view the Consumer Credit Card Agreement and Disclosure for additional details.

Third, there are usually fees. Most balance transfers come with a fee, anywhere from 3% to 5% of the balance you’re transferring. You’ll want to make sure the amount you save on interest more than covers the fee, or that the card has others features that make the fee worth paying, such as points or rewards. You will also want to know if there’s an annual fee on the card, which can be quite steep. Fortunately, there are cards out there with no transfer fees or annual fees … like Hanscom FCU’s cards!

Lastly, something a lot of borrowers don’t know until they apply: you can’t transfer debt between cards from the same issuer.

Work Your Plan

Once you’ve made the transfer, it’s important to have a plan and stick to it. If your goal was to eliminate high-interest debt, be sure you make monthly payments that chip that balance down to zero by the end of the promotion period. Keep an eye on monthly due dates; one late payment can turn your low promotional rate into a high-penalty interest rate. And if your goal is to pay off the debt completely, make sure you don’t add more debt to the card, especially if the promotional rate doesn’t apply to purchases.

Initiating a balance transfer can be a great way to save money, reduce debt, and breathe a little easier in the new year. Here at Hanscom FCU, we’re always looking for ways to help our members save more money, so if you’ve got some high-interest credit cards, stop by a branch or call us at 800-656-4328 to learn how a balance transfer or a debt consolidation loan could reduce your monthly payment in 2020.

Others are reading:

Comment