With COVID-19, the global economy is taking a beating, millions of workers have lost their jobs, and we are facing difficult decisions about the future. Many are feeling stressed to the max about their financial security. Here are some steps you can take to protect your money in uncertain times:

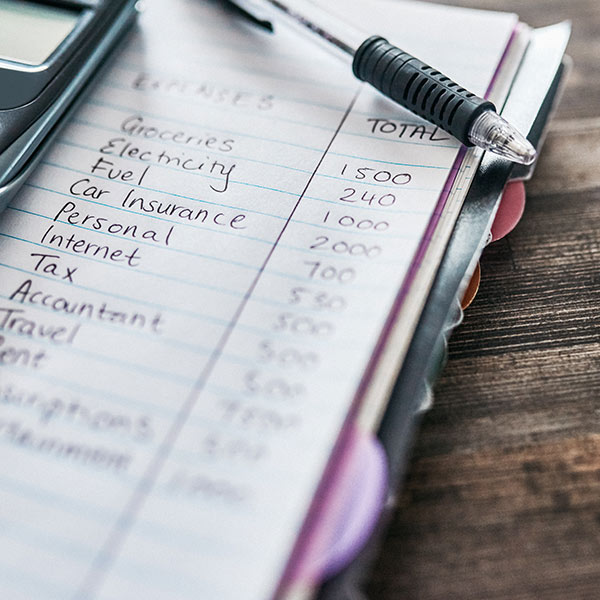

Rework your budget.

Now’s the time to look closely at your income and expenses, and run the numbers to identify any gaps that need to be filled. Look for ways to cut back on discretionary spending. If you’re staying home, you might spend less on transportation and going out, but you may need to budget more for higher grocery bills and other essentials.

Trim your bills.

Make a list of upcoming large expenses and consider if any of these purchases can be postponed. Contact your utility providers to find out if they offer skip a payment programs for those affected by COVID-19. Consider downsizing or dropping the features you don’t need for TV, phone and internet. You may be able to temporarily pause service for a few months to give your budget a break.

Check your emergency savings.

Having an emergency fund can be a lifesaver. With three to six months’ worth saved up for emergencies, you could avoid racking up credit card debt or cashing out retirement accounts to pay the bills. Think about how you might stretch your emergency savings to last for a longer period of time, if needed.

Use credit wisely.

When money’s tight, it’s tempting to use credit cards to get by for a few months. However, charging up a mountain of debt that you can’t afford to repay can damage your credit score, making it harder or more expensive to borrow money in the future. If you rely on credit cards or other loans in a financial pinch, have a plan ready to repay the debt and keep up with minimum payments (or more) each month, if possible.

Seek financial relief.

Evaluate all of the benefits available to you through the Coronavirus Aid, Relief and Economic Security (CARES) Act, including direct stimulus check payments to eligible Americans, expanded unemployment benefits, forbearance of mortgages for those affected by COVID-19 and a delay of payments on all federal student loans until Sept. 30, 2020.

Keep a long-term outlook.

Are you worried about wild fluctuations in the stock market? If anxiety about your investments is keeping you up at night, it’s a sign you should revisit your risk tolerance and review your accounts with a financial advisor. However, if your risk tolerance and goals are unchanged, then you may want to stay the course and ride out market volatility.

Talk to a financial advisor.

Whatever financial challenges you’re dealing with today, we’re ready to help you find solutions. Connect with a financial advisor at Hanscom Investment Services* by calling 800-656-4328 ext. 2236.

* Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Hanscom Federal Credit Union is not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Hanscom Investment Services, and may also be employees of Hanscom Federal Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Hanscom Federal Credit Union. Securities and insurance offered through LPL or its affiliates are:

Not Insured by NCUA or Any Other Government Agency / Not Hanscom Federal Credit Union Guaranteed / Not Hanscom Federal Credit Union Deposits or Obligations / May Lose Value

Comment