A routing number is a 9-digit code identifying a financial institution, such as a credit union, bank, or investment firm. Hanscom FCU's routing number is 2113-8048-3. This number helps reduce confusion between financial institutions that may have similar names and allows money to flow between these institutions without glitches. Sometimes an institution may have more than one routing number depending on its size and the type of account (checking account vs. investment account, for example).

If you're establishing direct deposit through your employer, ordering checks, or transferring money between financial institutions, you'll be asked to provide a routing number along with your personal account number to execute the transaction.

One way to think of a routing number is that it's the number of the house where your money gets delivered. The account number indicates the specific room where your money should be stored.

Where do I find the routing number?

There are five places you can find your financial institution's routing number:

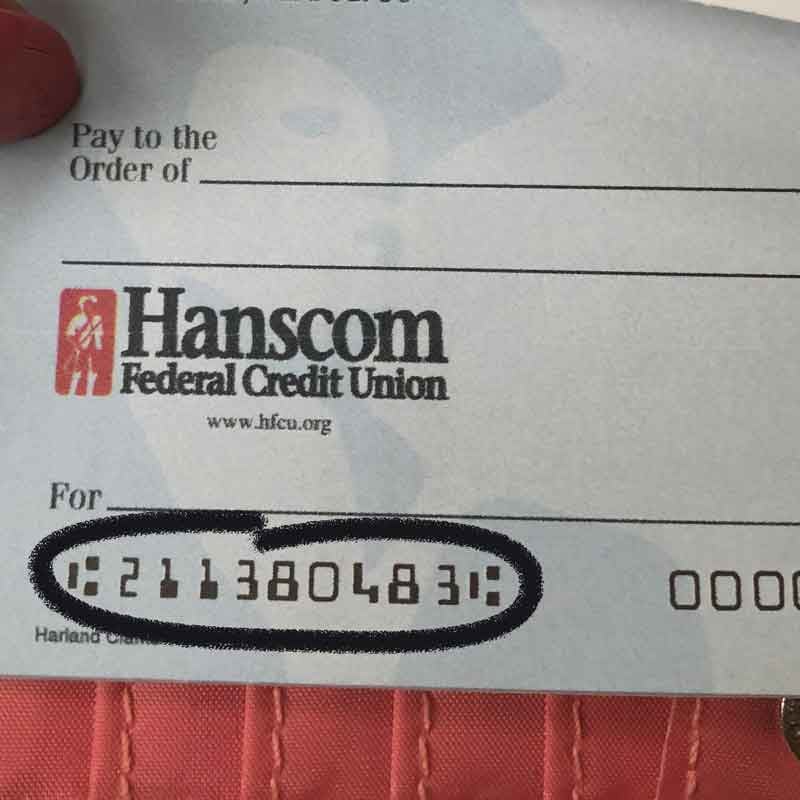

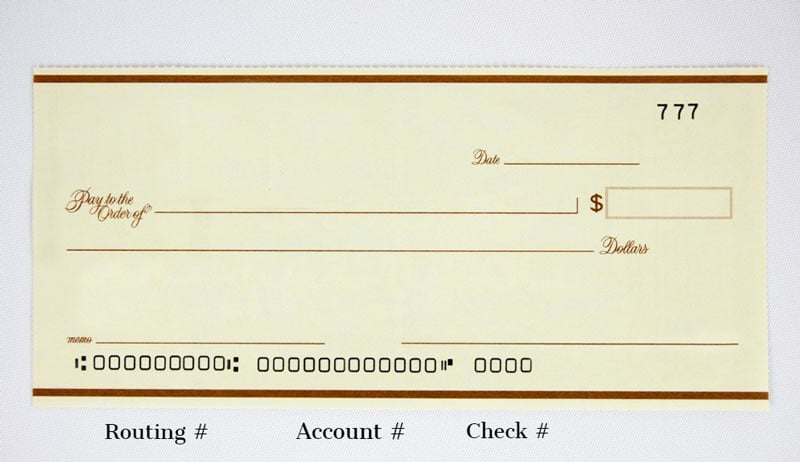

1. On your check. Routing numbers are the first nine digits you see on the bottom left of your check.

The next series of digits are your account number. Then the last four digits represent your check number.

2. On your financial institution's website. It's usually on the main page, but if it's not, use the search bar and type in "routing number" or try checking their FAQs. You'll find our routing number at the bottom of our main page.

3. By calling. Your financial institution probably has a call center or member services department happy to help you. Hanscom FCU's Call Center is always delighted to give our members this number when they can't find it elsewhere. You can reach them at 800-656-4328.

4. Googling it. Type in the financial institution's name plus "routing number" and chances are good that number will pop to the top of search results.

5. Looking it up at the American Banker's Association website. You'll need the name and state where the institution is located; you're limited to 2 searches a day for a maximum of 10 per month. You can also search by routing number at the site.

Hanscom FCU's routing number is 2113-8048-3.

It's very important to be very sure of the routing number you're using or you risk having your money not go where it's supposed to go! Be sure by double-checking the routing number you have before you initiate a transaction.

So now that you know our routing number, why not sign up for direct deposit with your employer? When you get direct deposit with Hanscom FCU, you can get paid up to two days earlier with Payday Perqs.

Others are reading:

- 5 Surprising Things I Learned About My Credit Report

- The #1 Tip to Avoid Being Scammed in a P2P Transaction

- How to Keep College Debt in Check

- Here's How to Avoid Rising ATM Fees

- When to Use Credit vs. Debit Cards

Comment