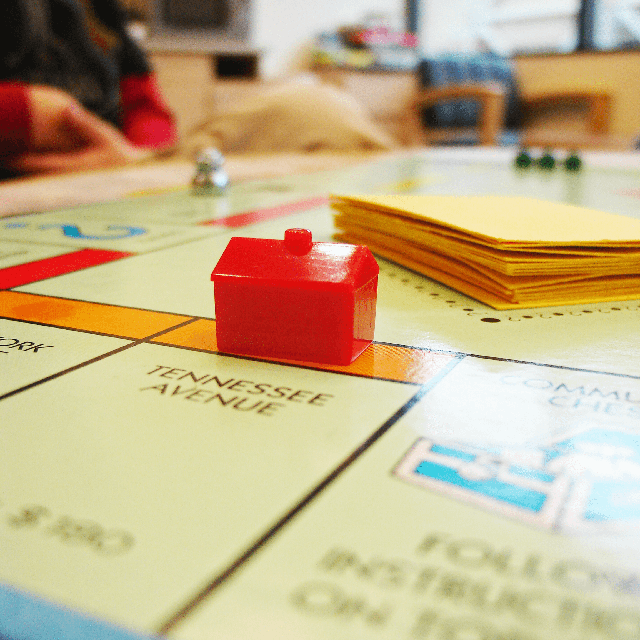

My daughter is a Monopoly fan. She is positively gleeful when charging her brother $2,000 rent on Boardwalk with a hotel. I look on it as a relatively harmless way to work out sibling rivalry. However, I do object to the Community Chest card advising “Bank Error in Your Favor – Collect $200.” As wonderful as it sounds, unexplained funds that show up in your account are not a windfall.

Does that happen in real life? Yes. Recently, a report surfaced about a credit union member who received erroneous direct deposits for almost 2 ½ years. The funds belonged to another member who mistakenly deposited the funds in her account.

When the error was discovered, the member receiving the funds initially refused to return them – and is now pleading guilty to receiving stolen goods.

Fortunately, you have access to a set of tools that can prevent this from ever happening to you. They’re easy to set up and won’t take up extra time in your day.

The key to keeping tabs on your accounts is having online account access. You won’t have to wait for a monthly statement to see your transactions. It’s secure, simple to use, and best of all, there’s no fee. Check your phone plan to see if there’s a charge for texts or for access to your email.

Set up alerts so you get a text or email whenever there’s a transaction. You’ll know right away, even if you rarely use the account. If you can’t account for a transaction, or if you don’t see what you expect, contact us right away. Click on the specific transaction and click the “Ask about transaction” link.

For accounts with frequent transactions, set alerts for a negative balance or transactions over a certain amount. Then keep an eye on things by logging in to your account regularly.

It’s unlikely that you’ll ever be involved in an erroneous deposit, but it’s a smart idea to review your accounts regularly.

And you may want to replace that Monopoly card with an updated message. The “Get out of jail free” card doesn’t work in real life, either.

.jpg)

Comment