When you finance or lease a car, light truck, or SUV, did you know that if it's totaled or stolen, you could be facing a major risk that your auto insurance policy may not cover? That risk is an auto loan deficiency, and Guaranteed Asset Protection (GAP) coverage can eliminate this risk. Here's what you need to know about auto loan deficiencies and how you can avoid them:

In the event of theft or total loss of your vehicle, most insurance companies will only pay the cash value of the vehicle at the time of the loss. Your remaining loan balance could be much greater than the cash value of your vehicle, which often creates a deficiency of several thousand dollars. This can happen if you don't make a significant down payment on your vehicle or if your vehicle depreciates in value faster than your loan balance. This auto loan deficiency is something you actually have to pay back to your lender, which can be tough news to swallow after a crisis. No one wants to owe money on a vehicle that's been stolen or that's waiting to be crushed in a junkyard.

GAP coverage protects you when you have a deficiency in your loan after an unrecoverable theft or total loss. Do you know what the "GAP" is on the vehicle you own today? You may be surprised at the answer! Check out our GAP calculator to learn if there's a gap in your insurance.

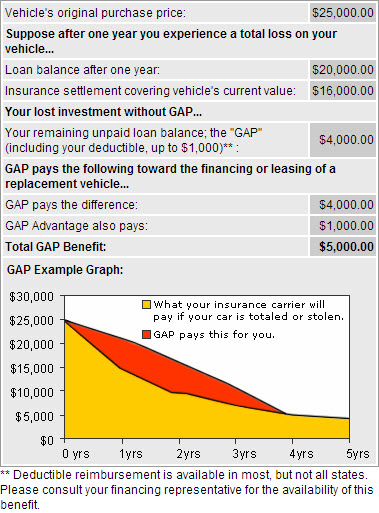

Here's an example:

There are other reasons why GAP coverage makes sense. For example, with Hanscom FCU's GAP Advantage program, not only are you protected when you owe more than what your vehicle is worth, you'll get $1,000 to put toward the purchase or lease of a new vehicle. And if you get into an accident with another vehicle that's titled and insured in your name, the plan will cover your deductible up to $500 as many times as needed for up to three years.

So if you're getting ready to buy or lease a new vehicle in the near future, be sure to inquire about GAP insurance. At $399, you'll be getting peace of mind for a few dollars a month. (Bonus: you can roll the fee into your loan!) Learn more about how our GAP Advantage program can benefit you here and eliminate the worry of what you'll do if your new car is totaled.

Others are reading:

-1.jpg)

Comment