Deciding among mortgage products and the rates associated with each can be overwhelming for home buyers. On a list of mortgage rates, you're going to see loan rates for both fixed-rate mortgages as well as adjustable-rate mortgages, commonly referred to as ARMs.

In this blog we're going to explain ARMs so that you can make the best financial decision for your needs. Here's what you need to know:

- An ARM has a fixed rate for the first several years of the loan term and is typically lower than any comparable rate you can get for a fixed-rate mortgage. At Hanscom Federal Credit Union, these initial rates may be fixed for 5, 7, or 10 years.

- Once the fixed-rate portion of the term is over, the ARM adjusts up or down based on current market rates. The rates are subject to caps that govern how much they can go up in any particular adjustment period. At Hanscom FCU, our ARM adjustments happen once per year.

- When the rate adjusts, the new rate is calculated by adding an index number to a margin specified in your mortgage documentation. Historically and typically, these adjustments follow the market rates.

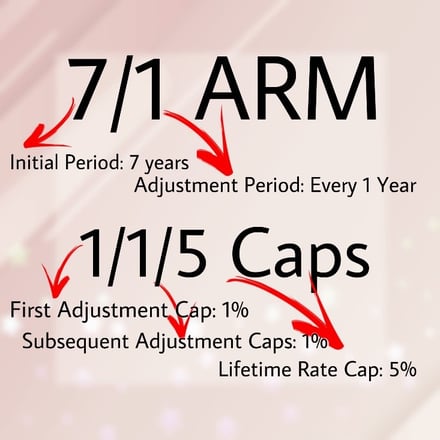

Here is an example of the First Time Homebuyer Helper (HLPR) 7/1 ARM offered by Hanscom FCU:

Now we'll break down the numbers for you in this example: a 7/1 ARM that starts with a fixed rate of 3.75%, caps of 1/1/5, a margin of 2.75%, an index tied to the one-year U.S. CMT (Constant Maturity Treasury) rate, and a floor of 2.75%, meaning it will never go below 2.75%. For the first seven years, the payments will be based on the 3.75% interest rate and then after seven years, the rate will change every year based on the CMT rate.

- Year 1 through Year 7 = 3.75%

- Year 8 (max decrease to 2.75% or max increase to 4.75%)

- Year 9 (max decrease to 2.75% or max increase to 5.75%)

- Year 10 - Year 30 (follow change based on prior year's rates. Rate cannot exceed 8.75%)

The Benefits of ARMs

- Lower rates mean a lower payment, so an ARM is easier on your wallet

- Qualify for a larger loan amount = bigger purchase amount

- Could be less expensive over the long term than a fixed rate if interest rates remain steady or drop

- Could be good for those who plan to be in the home for only a few years

The Drawbacks of Arms

- An increase in interest rates would lead to higher monthly payments in the future

Is an ARM Right for You?

Ask yourself these questions when you're trying to decide between a fixed-rate mortgage and an ARM:

- Is my income enough—or likely to rise enough—to cover higher mortgage payments with an ARM if interest rates go up?

- Will I be taking on other sizable debts, such as a loan for a car or school tuition, in the near future?

- How long do I plan to own this home? (If you plan to sell soon, rising interest rates may not pose the problem they do if you plan to own the house for a long time.)

Not All ARMs Are Created Equally

Other lenders may offer products where the rates change every six months, offer an option to pay interest only as part of your ARM offering, have much higher interest rate caps, or have prepayment penalties for paying off an ARM during the introductory period. This is why it is important to discuss the terms of the ARM with your loan officer. At Hanscom FCU, we want to make sure you are properly educated on the loan product you choose.

Since Hanscom FCU does not have any prepayment penalties, you can apply to refinance your ARM at any point in time, providing you have equity to do so. Most people will look to refinance their mortgage once it comes close to the adjustment period, or they may have already sold that home to move into a new home. Alternatively, depending on where rates are at the time and how much your rate is scheduled to adjust, you may be comfortable continuing with the ARM, especially if your interest rate hasn't changed that much.

It’s important to understand the full terms of the loan to determine if it is the right option for you. At the time of this writing, ARMs have a significantly lower rate than fixed-rate mortgages, so it could be a good option for many of our members. Be sure to take the time to contact one of our expert loan officers, Liz Clarke at 781-382-5064 or Scott Barry at 781-382-8455 to help determine the best option for you.*

*This blog was jointly written by Liz Clarke, NMLS #881030 and Scott Barry, NMLS #1210010

Others are reading:

.jpg)

Comment